Q4 2022 was challenging compared to prior years due to low consumer spending caused by inflation. Despite this, cookie alternative inventory helped save a disappointing Q4, giving advertisers greater efficiency and publishers increased incremental revenue.

The 33Across Programmatic Cookie Alternative Trends Report highlights buy-side and sell-side cookie alternative trends on the 33Across exchange during Q4 2022.

Specifically, the report answers the following questions:

Programmatic Advertisers:

- Which advertising vertical purchased the most cookie alternative inventory?

- What was the share of programmatic buying for each advertising vertical by cookie-state and how is this trending?

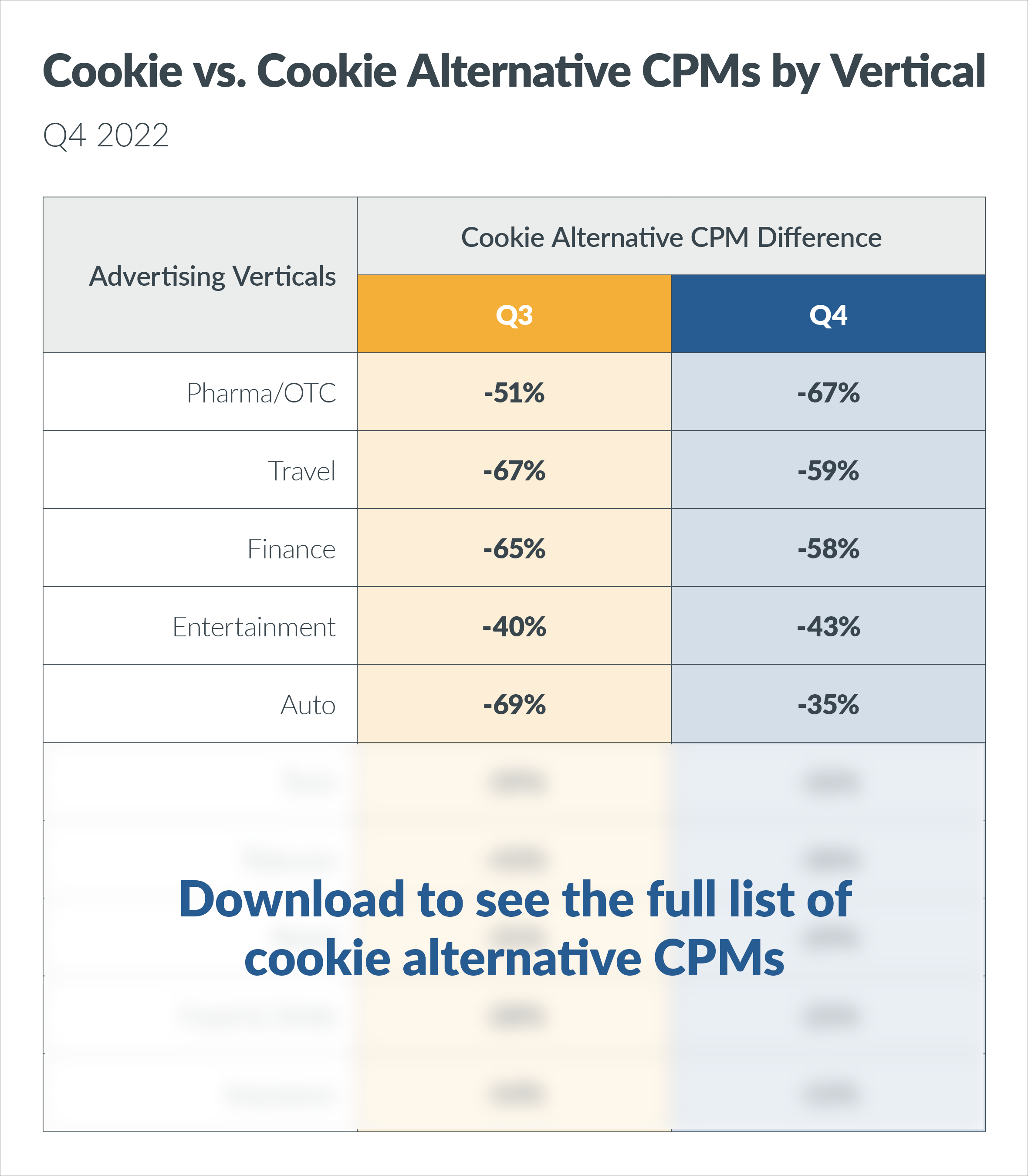

- How do cookie alternative CPMs compare to cookied CPMs for advertising verticals?

Supply:

- Which content categories monetized the most cookie alternative supply?

- What was the share of programmatic monetization for third-party cookies and cookie alternatives for each content category?

Key Findings:

1. Weak December Caused by Economic Slowdown

Consumer spending was down across almost every category*, forcing advertising to significantly reduce investment in comparison to past holiday seasons

2. Cookie Alternative Revenue Salvaged a Weak Q4

Even with a soft market, cookie alternative revenue grew across every publisher category in Q4, supporting the publisher opportunity for net-new revenue

3. Cookie Alternative Spend Surpasses Third-Party Cookie

Insurance advertisers spent more on inventory without third-party cookies in Q4, with an 18% increase in cookie alternative investment from Q3

4. Cookie Alternative Impressions Cost Less

Across all advertising verticals, there was up to a 67% CPM discount for cookie alternative inventory when compared to the third-party cookie inventory purchased

Download the full report here to see specific performance data, platform buying behaviors, digital ad spend trends, and more.

*US Commerce Department