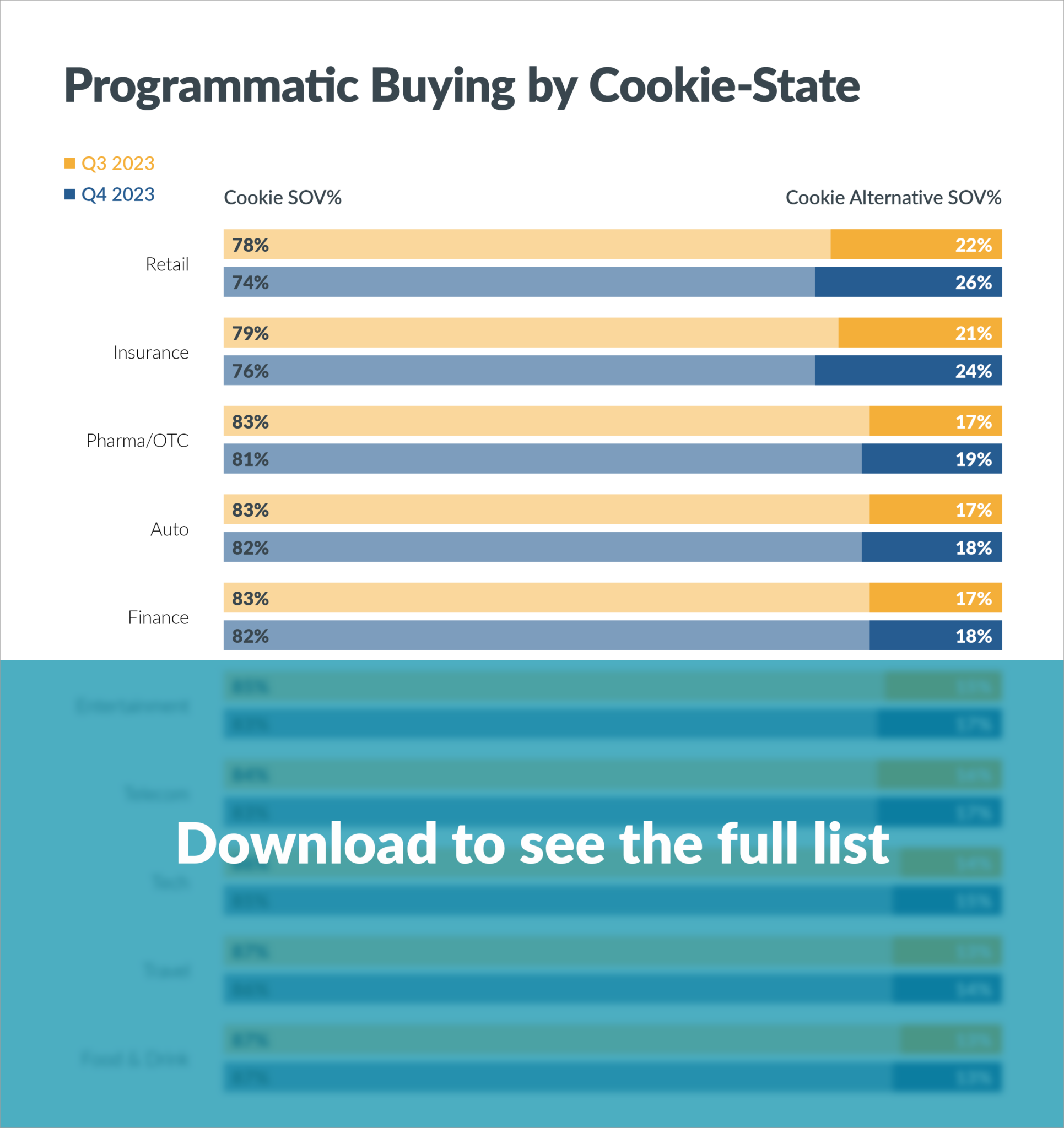

Since Google announced it would begin removing third-party cookies on 1% of Chrome users, more programmatic buyers have pushed to test alternative identifiers and solutions. On average, advertisers grew their cookie alternative1 investment by 13% quarter-over-quarter (QOQ) on the 33Across Exchange, increasing their cookie alternative share of voice (SOV) in Q4 by 9%. In particular, retail advertisers doubled their cookie alternative SOV year-over-year in the fourth quarter.

In the latest 33Across Programmatic Cookie Alternative Trends Report, we highlight buy-side and sell-side cookie alternative trends on the 33Across exchange during Q4 2023.

Specifically, the report answers the following questions:

Programmatic Advertisers:

- Which advertising vertical purchased the most cookie alternative inventory?

- What was the share of programmatic buying for each advertising vertical by cookie-state and how is this trending?

Supply:

- Which content categories monetized the most cookie alternative supply?

- What was the share of programmatic monetization for third-party cookies and cookie alternatives for each content category?

Key Takeaways:

1. Cookie Alternative SOV Grew by More Than Double YOY for Retail Advertisers

In Q4 2023 Retail advertisers invested 26% of their programmatic budgets in cookie alternative inventory, up 117% YOY

2. Advertisers Still Rely on Third-Party Cookies for Programmatic

Advertisers had a 9% average QOQ increase in cookieless SOV in Q4; however, they continue to rely heavily on third-party cookies

3. Cookieless SOV Increase for Travel Advertisers Correlates to Revenue Growth for Publishers

Travel advertisers grew their cookieless SOV by 8% from Q3 with heavy investment from booking sites and a leading vacation rental company, leading to a 10% revenue increase for Travel publishers

4. Publishers Increased Their QOQ Cookieless Revenue Across Most Categories in Q4

Seasonal events like holiday shopping, sporting events, and entertainment increased cookieless revenue by an average of 17% from Q3

Download the full report here to see specific performance data, platform buying behaviors, digital ad spend trends, and more.

1 Cookie alternative refers to identifiers exclusive of third-party cookies