In the recently produced 33Across Programmatic Cookieless Trends Report, we analyzed programmatic transactions on the 33Across exchange to gain insight into cookieless versus cookie trends for buyers and sellers during August and September 2022.

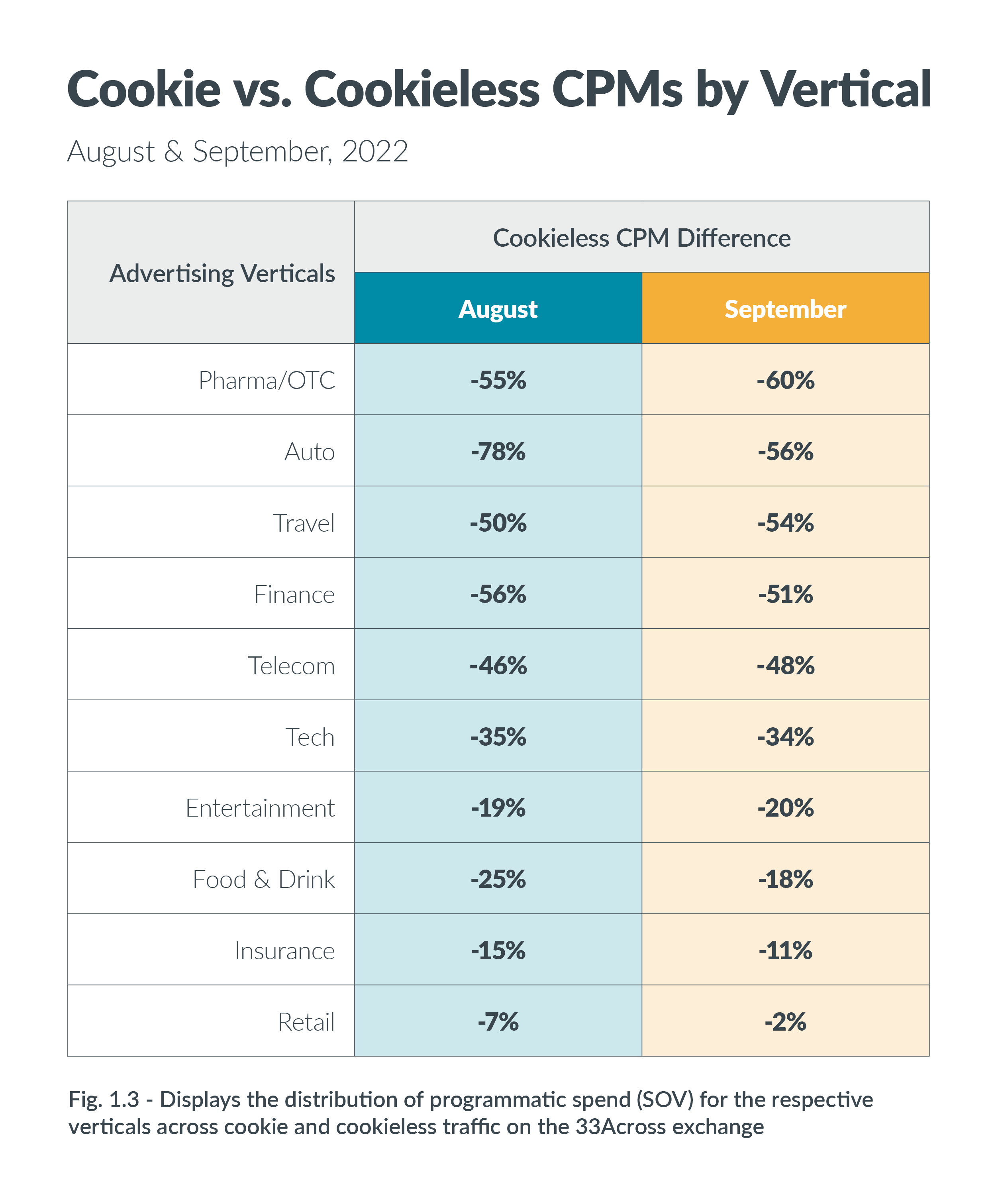

From a demand perspective, our report highlights performance for the top 10 advertising verticals on the 33Across exchange; Auto, Entertainment, Finance, Food & Drink, Insurance, Pharma/OTC, Retail, Tech, Telecom, and Travel. We observed multiple trends, including buying behaviors for cookied and cookieless inventory. With considerably less competition, we honed in on CPM variance across advertising verticals. Something to note is that market factors, such as seasonality, play a role in performance as we move from summer to fall.

Demand Exchange Insights:

- As more competition enters the marketplace, cookieless CPMs are beginning to rise across several categories

- In September 2022, the average cookieless CPM discount was 35% lower than cookied inventory

- Pharma/OTC, Auto, Travel, Finance, and Telecom averaged 50% lower CPMs for cookieless inventory

- Insurance discount is lessening due to increased competition on cookieless inventory

Opportunities:

- Due to demand increasing spend on cookieless inventory, CPMs will continue to slowly rise. Therefore, Q4 presents a near-term opportunity to capture value for advertisers

- Targeting cookieless inventory will nearly double campaign budgets and give access to new customers

- Marketers new to cookieless targeting should consider testing branding campaigns to reach new audiences at much lower CPMs

For more demand insights from August and September, 2022, such as verticals that spent the most on programmatic inventory and the pricing difference between cookied and cookieless impressions, download the full report here.

By: Lisa Mollura | VP of Marketing at 33Across