Overview

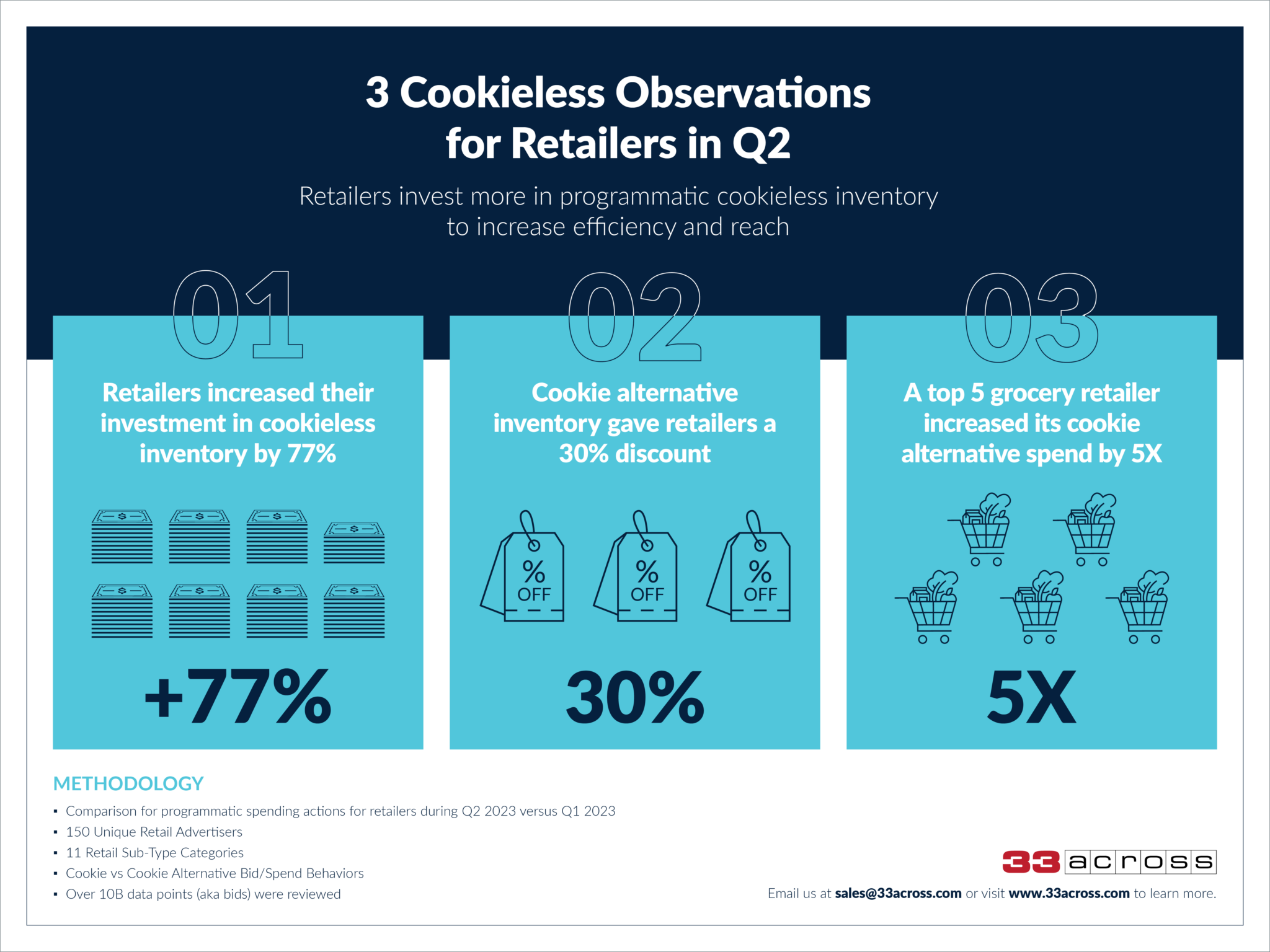

In 33Across’ Q2 Programmatic Cookie Alternative Trends Report (vol. 4), we analyzed programmatic transactions on the 33Across exchange to gain insight into cookie alternative versus third-party cookie buying trends for buyers and sellers. Retailers have long benefited from programmatic advertising’s ability to activate highly targeted campaigns and reach consumers throughout the customer journey. Accounting for 28% programmatic spending, Retail advertisers are the largest programmatic spender on the 33Across exchange. During Q2, Retailers increased their programmatic spend by 13%, largely driven by a 77% increase in purchasing cookieless inventory. We took a closer look at how retailers purchased programmatic inventory outside of the third-party cookie. Here’s what we observed.

Expanding to Cookieless Audiences

When it comes to Retail advertisers’ share-of-voice or the media spend distribution between third-party cookies and cookie alternative inventory, most of their programmatic media budgets have been focused on third-party cookies with little quarterly variance. However, in Q2, we saw that Retail advertisers had a 77% increase in cookie alternative media spend and in parallel their cookie alternative SOV increased by 57%. More addressability in the marketplace allows Retailers to target valuable iPhone users and uncover audiences in less saturated environments outside of third-party cookies.

Top 10 Programmatic Retailers

We observed that the top 10 retailers ranked by the National Retail Federation (NRF) shifted more of their programmatic spend to inventory outside of third-party cookies in Q2 on the 33Across exchange. Today, the majority of the marketplace focuses on highly competitive third-party cookie environments. We see these large retailers benefit from expanding their messaging to uncontested audiences resulting in new customers at 30% lower CPMs. Once the market catches up with more addressable signals and traditional-like capabilities, we expect prices to increase. Efficiency from cookieless inventory gives these large Retailers a competitive advantage.

Grocery Retailers

Grocery retailers significantly increased their investment outside of third-party cookies in Q2. One top 5 grocery retailer grew their cookie alternative share of voice (SOV) by 5X while a top 10 grocery retailer doubled their spend.

What’s next for retailers

Price-sensitive advertisers who need to reach new audiences in Safari and Firefox environments should begin to test and measure against the third-party cookie before Google begins removing third-party cookies in 2024. Retailers face extreme competition and advertisers need to use their full arsenal to capture market share. With the holiday season right around the corner and price-sensitive budgets, testing new tactics like sell-side targeting and cookie alternative retargeting to convert lower funnel opportunities will help marketers do more with less budget while reaching new audiences in cookieless environments.

Methodology

- Comparison for programmatic spending actions for retailers during Q2 2023 versus Q1 2023

- 150 Unique Retail Advertisers

- 11 Retail Sub-Type Categories

- Cookie vs Cookie Alternative Bid/Spend Behaviors

- Over 10B data points (aka bids) were reviewed

Interested in learning more about cookie alternative tactics for marketers?

Contact us to get expert advice.

By: Lisa Mollura | VP of Marketing at 33Across